Interest rates are the cost to borrow money or the reward for saving it. When you take out a loan, the interest rate is the extra amount you pay on top of what you borrowed. For savers, it’s what banks pay you for keeping your money with them. Interest rates play an important role in our financial lives, and affect everything from mortgages to credit cards to savings accounts.

Let’s understand this through an example:

Imagine you’re about to buy your first home. You’ve found a house for $300,000 and need to take out a mortgage. The bank offers you a 30-year loan with a 4% annual interest rate. This interest rate means you’ll pay an extra amount on top of the $300,000 you borrowed. Over the life of the loan, you’ll pay back not just the $300,000, but also a 4% annual interest rate over 30 years.

On the flip side, let’s say you have $10,000 in savings. If you put this in a savings account with a 1% annual interest rate, the bank will pay you $100 per year for keeping your money with them.

This scenario shows how interest rates work for both borrowers and savers.

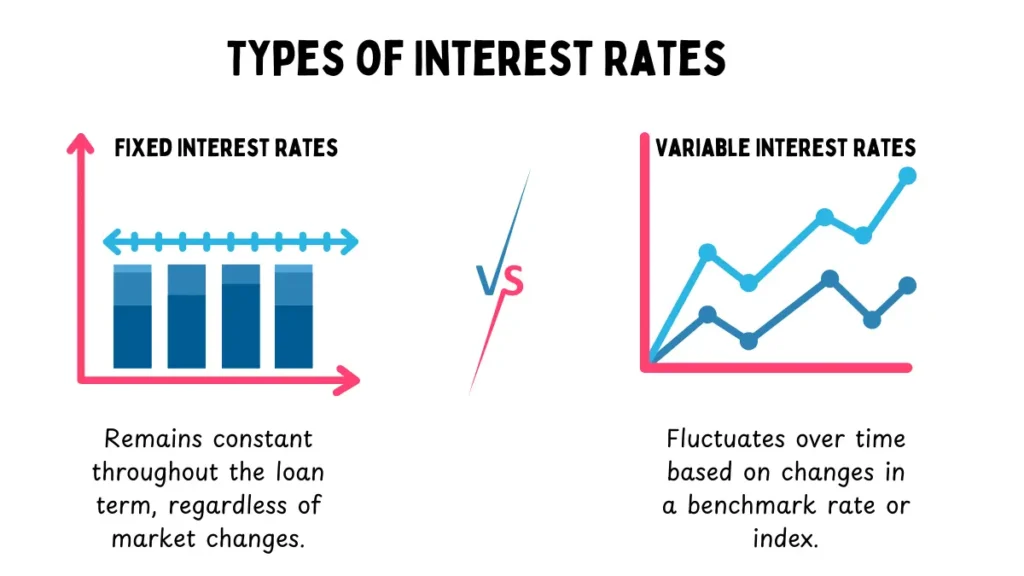

A fixed-rate stays the same throughout the life of a loan or savings account. A variable rate, sometimes called an adjustable or floating rate, can change over time based on economic factors. This difference is important when you’re choosing a mortgage or opening a savings account.

APR shows the yearly cost of a loan including fees, while APY tells you how much you’ll earn on your savings in a year.

Read What is Income?

How Interest Rates Are Adjusted?

Interest rates are adjusted primarily by central banks, like the Federal Reserve, to maintain economic stability and manage liquidity. These institutions typically focus on a short-term policy rate, such as the overnight rate banks charge each other for loans. Central banks use two main methods to adjust rates:

- The central bank buys or borrows securities, which usually lowers the rate.

- The central bank absorbs reserves, which typically raises the rate.

These adjustments to the policy rate are expected to influence other interest rates throughout the economy. Central banks consider various economic factors when making these decisions, including:

- Economic growth

- Inflation rates

- Employment levels

- Financial market conditions

When the economy is strong, rates tend to be increased to prevent overheating. Conversely, when the economy is weaker, rates are often lowered to encourage borrowing and spending. Thus it stimulates economic activity.

Understanding how interest rates work can help you make smarter financial choices. For borrowers, lower rates usually mean cheaper loans. For savers, higher rates mean better returns on your money. [1] [2]

What are Negative Interest Rates?

Negative interest rates are a rare but real phenomenon in the financial world. In this unusual situation, savers actually pay banks to hold their money, rather than earning interest. While this might sound strange, it sometimes happens when economies are struggling. The U.S. hasn’t seen negative rates, but some countries have used them to try to boost spending and investment.

Interest Rate Risk

Interest rate risk affects both borrowers and savers. For borrowers with variable-rate loans, rising rates can make monthly payments more expensive. Imagine your mortgage payment suddenly jumping up – that’s interest rate risk in action. On the flip side, savers face risk when rates fall. If you’ve locked in a good rate on a long-term savings account, you’re in luck. But if rates drop when you’re looking to invest, you might find your money earning less than you hoped.

These risks show why it’s important to understand how interest rates work. When you’re taking out a loan, consider whether a fixed or variable rate makes more sense for your situation. For savers, consider how long you want to commit your money and what you think rates might do in the future. By keeping an eye on interest rate trends, you can make smarter choices with your money.

Types of Interest Rates

When dealing with loans or savings, you’ll come across two main types of interest rates: fixed and variable. Understanding these can help you make smarter financial choices.

Fixed Interest Rates

Fixed interest rates stay the same throughout the loan or investment term. This means your rate won’t change, regardless of what happens in the broader economy. You’ll typically find fixed rates on:

- Mortgages

- Personal loans

- Certificates of deposit (CDs)

- Some student loans

The big advantage of a fixed rate is its predictability. Your payments remain constant, making budgeting easier. For example, with a fixed-rate mortgage, your monthly payment stays the same for the life of the loan. However, you might miss out if market rates drop significantly after you’ve locked in your rate.

Variable Interest Rates

Variable interest rates, also called adjustable or floating rates, change over time based on economic conditions. These rates are usually tied to a benchmark index like the prime rate or LIBOR (London Interbank Offered Rate). You’ll commonly see variable rates on:

- Credit cards

- Adjustable-rate mortgages (ARMs)

- Home equity lines of credit (HELOCs)

- Some private student loans

The potential benefit of a variable rate is that it often starts lower than a fixed rate. If rates fall, you could save money. For instance, if you have an ARM and interest rates drop, your monthly mortgage payment could decrease. But there’s a flip side: if rates rise, your payments could increase, sometimes significantly.

Variable rates can be more complex. For example, an ARM might offer a low fixed rate for an initial period (say, 5 years), and then switch to a variable rate for the remainder of the loan term.

Both types of interest rates have their place in personal finance. Fixed rates offer stability and are great when rates are low. Variable rates can save you money if rates stay low or fall, but they come with more risk. Your best choice depends on your financial situation, risk tolerance, and current market conditions.

In future articles, we’ll explore each type in more depth, looking at their advantages and disadvantages in various financial products.

Simple Interest

Simple interest is straightforward. It’s calculated only on the principal amount.

Here’s how it works:

- You borrow $1,000 at 5% simple interest for 3 years.

- Each year, you’ll owe 5% of $1,000, which is $50.

- After 3 years, you’ll owe $150 in interest (3 x $50).

The formula is:

Simple Interest = Principal x Rate x Time

Simple interest is often used for short-term loans or basic savings accounts.

Compound Interest

Compound interest is more complex but can be more powerful. It’s interest on interest – you earn returns not just on your initial investment, but also on the interest you’ve already earned.

Here’s a basic example:

- You invest $1,000 at 5% compound interest.

- After the first year, you have $1,050.

- In the second year, you earn 5% on $1,050, not just the original $1,000.

The basic formula is:

A = P(1 + i)^t

Where A is the final amount, P is the principal, i is the annual interest rate, and t is the number of years.

Compound interest can have a dramatic effect over time. This is why it’s often called the “eighth wonder of the world” in investing. A small amount invested early can grow significantly over decades.

The Rule of 72 is a quick way to estimate how long it will take your money to double with compound interest. Just divide 72 by your interest rate. For example, at 6% interest, your money would double in about 12 years (72 ÷ 6 = 12).

Understanding these concepts can help you make better decisions about savings, investments, and loans. Compound interest can work for you when you’re saving or investing, but against you when you’re borrowing. That’s why it’s crucial to start saving early and to be careful with high-interest debt.

APR vs. APY

When dealing with interest rates, you’ll often come upon two important terms: APR (Annual Percentage Rate) and APY (Annual Percentage Yield).

APR (Annual Percentage Rate)

APR is the yearly cost of borrowing money. It’s more than just an interest rate – it includes the interest rate plus other charges associated with the loan. This makes APR a more comprehensive measure of borrowing costs. You’ll commonly see APR used for:

- Credit cards

- Mortgages

- Personal loans

- Auto loans

The lower the APR, the less you’ll pay to borrow money. However, it’s important to note that APR doesn’t account for compounding interest.

APY (Annual Percentage Yield)

APY shows the total amount of interest you could earn on savings or investments over a year, taking into account compound interest. You’ll typically see APY used for:

- Savings accounts

- Certificates of deposit (CDs)

- Money market accounts

While a higher APY means potentially more earnings, it’s crucial to understand that APY is not a guaranteed return. Your actual earnings can vary based on factors like market conditions, account balance, and how often interest is compounded.

Key Differences

- Purpose: APR is for borrowing; APY is for saving or investing.

- Compounding: APR doesn’t account for compounding, while APY does.

- Fees: APR includes charges; APY typically doesn’t.

- Calculation: APR is a simpler calculation, while APY factors in compounding frequency.

Why It Matters?

When comparing financial products, it is important to understand the difference between APR and APY. For loans, a lower APR generally means lower costs. For savings, a higher APY potentially means better returns.

A mortgage might advertise an interest rate of 3.5% but have an APR of 3.8% when fees are included. For savings, an account might offer a 2% interest rate, but if interest compounds daily, the APY could be slightly higher at 2.02%.

When evaluating financial products, always compare APRs for loans and APYs for savings to get the most accurate picture of costs or potential earnings. Remember, even small differences can have a significant impact over time, especially for long-term loans or investments.

How Interest Rates Affect You in USA?

Interest rates play an important role in shaping the U.S. financial markets and the broader economy. When the Federal Reserve adjusts them, it affects how money moves through the entire U.S. market. Lower rates make borrowing cheaper, which usually encourages spending and investment. This can boost stock prices as companies may see higher profits.

However, if rates stay low for too long, it might lead to inflation as too much money chases too few goods. On the flip side, when the Fed raises rates, it becomes more expensive to borrow. This can slow down spending and investment, potentially causing stock prices to dip. It also affects the bond market, making new bonds more attractive but decreasing the value of existing ones.

While the stock market often reacts quickly to these changes, the broader economy takes longer to feel the full effects. Understanding this relationship helps investors navigate the market’s ups and downs as interest rates fluctuate.

How Interest Rates Affect You in UK?

Interest rates in the UK play a vital role in shaping the economy and affecting millions of people’s finances. The Bank of England sets the base rate, which influences the cost of borrowing and the rewards for saving across the country.

Currently, the UK base rate stands at 5.25%, the highest in 16 years. This rate impacts mortgage payments, credit card rates, and savings returns. The Bank adjusts rates primarily to control inflation, aiming to keep it near the 2% target.

Recently, inflation in the UK hit the 2% target, leading to speculation about potential rate cuts. However, the Bank must balance controlling inflation with avoiding economic damage. They’re watching other inflation indicators, like price rises in the service sector, before deciding to cut rates.

For UK homeowners, these rates directly affect mortgage costs. About 1.2 million people on tracker or standard variable rate mortgages see immediate changes in their payments when rates shift. The majority on fixed-rate deals will feel the impact when they remortgage.

How Interest Rates Affect You in Canada?

Interest rates play a significant role in shaping the financial landscape for Canadians. Here’s how interest rates impact someone living in Canad

- Mortgage Costs – For many Canadians, their home is their largest investment. When interest rates rise, mortgage payments increase for those with variable-rate mortgages or those renewing fixed-rate mortgages. This can significantly affect household budgets.

- Savings and GICs – Higher interest rates can be beneficial for savers. Banks may offer more competitive rates on savings accounts and Guaranteed Investment Certificates (GICs), allowing Canadians to earn more on their deposits.

- Credit Card Debt – As interest rates rise, so do the costs of carrying credit card balances. This can make it more expensive for Canadians to manage their consumer debt.

- Investment Returns – Interest rates affect various investments differently:

- Bond prices typically fall when rates rise, impacting bond fund returns.

- Higher rates can make dividend-paying stocks less attractive, potentially affecting stock market performance.

- Rising rates might boost returns on interest-bearing investments like money market funds.

- Canadian Dollar – Interest rates can influence the value of the Canadian dollar, affecting the cost of imports and travel for Canadians.

- TFSA and RRSP Strategies – Changing rates might influence how Canadians allocate their investments within Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs).

- Business Loans – For Canadian entrepreneurs and small business owners, higher rates mean increased borrowing costs, potentially affecting business growth and hiring decisions.

- Student Loans – While federal student loans in Canada have fixed interest rates, those with private student loans might see their payments increase with rising rates.

- Overall Economic Impact – The Bank of Canada uses interest rates to manage inflation and economic growth, indirectly affecting job markets and overall economic conditions for Canadians.

Conclusion

Interest rates play an important role in our financial lives, affecting everything from mortgages and credit cards to savings accounts. They represent the cost of borrowing money or the reward for saving it. Understanding different types of interest rates (fixed, variable, APR, APY) and how they work can help you make smarter financial decisions. Interest rates impact the economy, influencing spending, investment, and inflation. They vary across countries and financial products, affecting mortgages, credit cards, loans, and savings differently.

Consider seeking professional financial coaching services to navigate this complex financial landscape and make the most of your money. An expert can help you understand how interest rates apply to your situation and develop strategies to optimize your finances. Contact us today to schedule a consultation and take the first step toward financial success.

FAQs

How do interest rates work?

Interest rates represent the cost of borrowing money. It is expressed as a percentage of the loan amount. They determine how much extra you pay beyond the principal on loans or earn on savings.

How do interest rates work on credit cards?

Credit card interest is calculated daily. The APR is divided by 365 to get a daily rate, which is applied to your daily balance. This accumulated interest is added to your balance monthly if not paid in full.

How do interest rates work on student loans?

Student loan interest is typically calculated daily. The annual rate is divided by 365, and this daily rate is applied to your balance. Interest accrues over time, often even while you’re in school.

How do interest rates work on mortgages?

Mortgage rates can be fixed (staying constant) or adjustable (changing periodically). The interest portion of your payment decreases over time as more goes toward the principal.

How do interest rates work on car loans?

Car loan interest rates are usually fixed and applied to the loan balance. They determine your monthly payment amount and the total cost of the loan over its term.

How do interest rates work on personal loans?

Personal loan interest is typically expressed as an APR, which includes the interest rate plus fees. This rate is applied to your borrowed amount to determine the total repayment cost.

How do interest rates work on HELOC (Home Equity Line of Credit)?

HELOC rates are usually variable, based on a benchmark index rate plus a lender-set margin. Interest is only charged on the amount you’ve borrowed from your credit line.