Income is the foundation of financial health, which comes in various forms like earned, passive, and investment income. Understanding these types and their tax implications is important for effective money management and long-term financial security.

In this article, we will discuss income types, their characteristics, tax treatments, and how they impact your financial well-being.

What is Income?

Income is the money received by individuals or entities in exchange for their labor, products, or investments. It includes wages, salaries, business profits, interest, and dividends. In financial contexts, income can be defined differently depending on the specific domain:

- For taxation, it’s earnings subject to tax regulations

- In accounting, it represents revenue from business operations

- Economic analysis considers all monetary inflows as income

Income may be measured by gross income (total earnings before deductions), net income (earnings after taxes and other deductions), or discretionary income (funds available after essential expenses).

In general terms, income represents the financial resources gained over a particular period, typically measured annually. This includes wages, salaries, profits from business operations, interest earned on savings, dividends from investments, and other forms of monetary gain.

Features of income

Income has three key features that shape your financial planning:

- First, income regularity tells you how often money comes in. Your monthly paycheck creates a steady cash flow. It makes it easier to budget and pay bills on time. But what about yearly bonuses or freelance gigs? These irregular payments require more flexible planning. How can you balance your spending when income isn’t consistent?

- Second, income measurability means you can track your earnings precisely. A fixed salary in dollars or euros is easy to count and analyze. Can you accurately measure all your income sources? Some, like tips or variable commissions, might need special tracking methods. Knowing exactly how much you earn helps you set realistic financial goals and measure your progress.

- Third, income source reveals where your money comes from. Does your paycheck come from a job, investments, or government benefits? Each source affects your financial stability differently. Why is diversifying income sources important? It’s like not putting all your eggs in one basket. it protects you if one source dries up. Plus, different income types may have unique tax rules.

Income’s characteristics influence budgeting strategies, financial tracking, and long-term security. The accessibility of income and its variability due to external factors further impact financial management approaches.

Also Read Does Bankruptcy Clear Utility Bills?

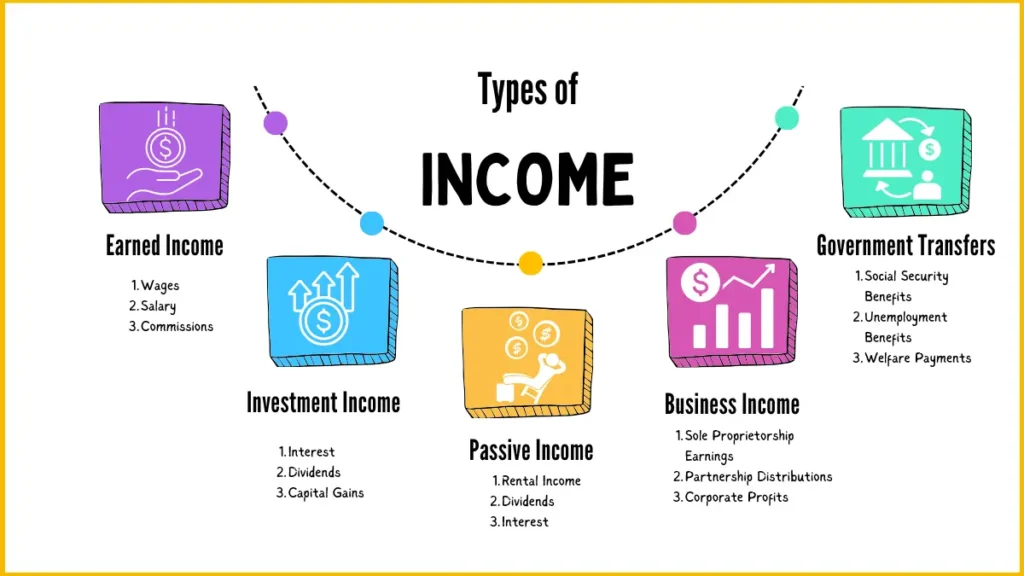

Types of Income by Source

Here are the main income types based on their origin:

| Income Category | Description | Examples |

| Earned Income/Employment Income | Income from active work or services | • Wages |

| • Salaries | ||

| • Commissions | ||

| • Tips | ||

| • Self-employment earnings | ||

| Investment Income | Income from financial assets | • Interest |

| • Dividends | ||

| • Capital gains | ||

| Passive Income | Income requiring minimal ongoing effort | • Rental income |

| • Royalties | ||

| • E-commerce profits | ||

| Government Transfers | Income from public assistance programs | • Social Security benefits |

| • Unemployment benefits | ||

| • Welfare payments | ||

| Other Income | Miscellaneous revenue sources | • Prizes and awards |

| • Gambling winnings | ||

| • Gifts | ||

| • Alimony |

1. Employment Income

Employment income is the most common form of revenue for most individuals. It includes money earned through direct labor or services provided to an employer. Here are a few examples:

- Salary – Fixed annual compensation, typically paid in regular installments.

- Example – Sarah earns a $60,000 annual salary as a marketing manager.

- Wages – Hourly pay for work performed, often in service or manufacturing sectors.

- Example – David makes $15 per hour working at a local grocery store.

- Commissions – Performance-based earnings, usually a percentage of sales or deals closed.

- Example – Maria, a real estate agent, earns a 3% commission on each property she sells.

- Bonuses – Additional compensation for exceptional performance or company success.

- Example – John receives a $5,000 year-end bonus for exceeding his sales targets.

- Tips – Supplementary payments from customers, common in hospitality and service industries.

- Example – Lisa, a waitress, earns an average of $100 in tips per shift.

Employment income typically provides stability but may be limited by factors such as available working hours or job market conditions.

2. Business Income

Business income stems from operating a company or engaging in self-employment activities. This category includes:

- Sole Proprietorship Earnings – Profits from a business owned and operated by one individual.

- Example – Tom’s freelance web design business generates $70,000 in annual profit.

- Partnership Distributions – Income shared among business partners based on their agreement.

- Example – Amy and Rachel split the $100,000 profit from their bakery equally.

- Corporate Profits – Earnings distributed to shareholders of a corporation.

- Example – XYZ Corp pays out $2 per share in dividends to its stockholders.

Business income can offer higher earning potential but often comes with increased risk and responsibility compared to employment income.

3. Investment Income

Investment income is generated from financial instruments and assets, representing a return on existing capital. This category includes:

- Interest – Earnings from savings accounts, bonds, or loans. Example – Mark earns $500 annually in interest from his high-yield savings account.

- Dividends – Distribution of company profits to shareholders. Example – Emily receives $1,000 in quarterly dividends from her stock portfolio.

- Capital Gains – Profits from selling investments at a higher price than purchased. Example – Alex sells his tech stocks for a $10,000 profit after holding them for two years.

- Rental Income – Money earned from leasing out property. Example – The Smiths earn $1,500 monthly by renting out their vacation home.

Investment income can provide passive earnings but is subject to market fluctuations and economic conditions.

4. Government Transfers

This category encompasses financial support provided by government programs:

- Social Security Benefits – Retirement or disability payments from the federal government.

- Example – Retired teacher Susan receives $1,800 monthly in Social Security benefits.

- Unemployment Benefits – Temporary financial assistance for individuals who have lost their jobs.

- Example – After being laid off, Mike collects $400 weekly in unemployment benefits.

- Welfare Payments – Assistance programs for low-income individuals and families.

- Example – The Johnson family receives $500 monthly in food assistance through SNAP.

Government transfers can provide crucial support but often have eligibility requirements and may not fully replace other income sources.

5. Other Income

This catch-all category includes various forms of income that don’t fit neatly into the above classifications:

- Prizes and Awards – Monetary winnings from contests or recognition.

- Example – Jennifer wins $5,000 in a local photography competition.

- Gambling Winnings – Profits from games of chance or betting activities.

- Example – Carlos wins $1,000 on a lucky scratch-off lottery ticket.

- Gifts – Monetary presents received from others (typically not taxable).

- Example – Samantha receives $2,000 in cash gifts from relatives for her wedding.

- Alimony – Court-ordered payments from a former spouse following divorce.

- Example – Following her divorce, Laura receives $1,500 monthly in alimony payments.

While these income sources can provide financial windfalls, they are often unpredictable and shouldn’t be relied upon for long-term financial planning.

Unearned Income

Some income types (within the investment and other income categories) are considered “unearned income.” This term refers to money received without active work or effort on the recipient’s part. Examples include interest, dividends, and some forms of rental income.

While unearned income can contribute significantly to financial well-being, it’s important to recognize that it may be taxed differently than earned income from employment or active business participation. However, the primary focus should be on understanding and diversifying your income sources to create a stable financial foundation.

Income Types by Tax Treatment

There are 4 main types of income based on how they are taxed:

Earned Income

Earned income, derived from active work, faces standard income tax rates. This category includes:

- Wages and salaries from employment

- Commissions and tips

- Self-employment earnings

Earned income is subject to progressive tax brackets, with higher earners paying a larger percentage. How does this impact your take-home pay?

Passive Income

Passive income often receives distinct tax treatment. Main types of passive income include:

- Rental income from real estate

- Dividends from stocks

- Interest from savings or investments

While generally taxed as ordinary income, some passive income sources (like qualified dividends) may enjoy preferential rates. How can you leverage passive income in your financial strategy?

Capital Gains

Capital gains taxation varies based on holding period:

- Short-term gains (assets held ≤1 year) – Taxed as ordinary income

- Long-term gains (assets held >1 year) – Benefit from lower tax rates

This structure encourages long-term investment. How might this influence your investment decisions?

Tax-Exempt Income

Some income sources escape taxation entirely:

- Interest from municipal bonds

- Certain Social Security benefits

- Qualified Roth IRA distributions

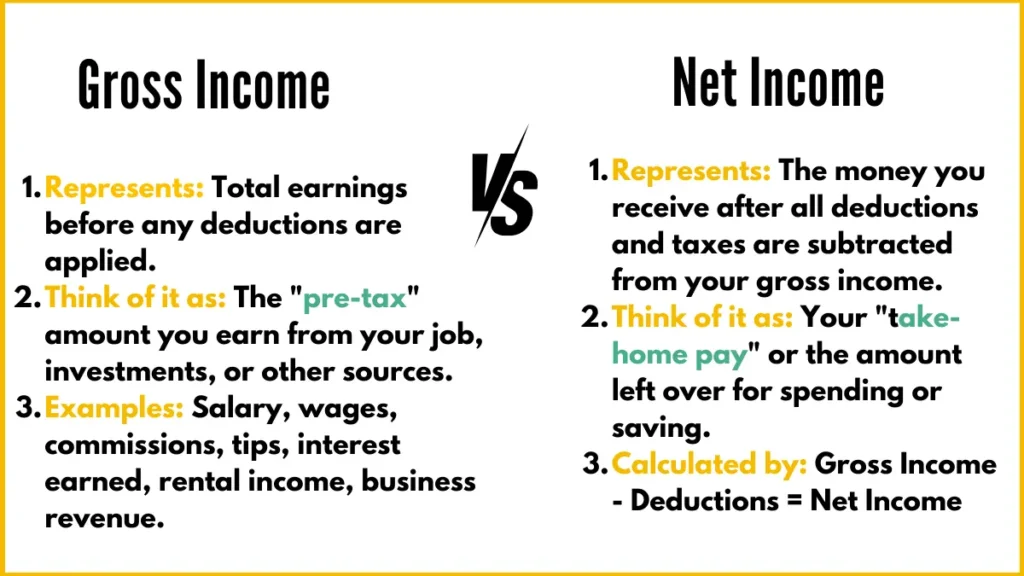

Gross Income vs. Net Income

Gross Income represents your total earnings before any deductions are made. It’s the full amount you’ve earned based on your salary or hourly wage. Net Income, often called “take-home Income,” is the amount you receive after all deductions have been subtracted from your gross Income.

Common Deductions

- Federal Income Tax – Withheld based on your W-4 form and tax bracket.

- State and Local Taxes – Vary by location but often include income tax and sometimes city taxes.

- Social Security – Currently 6.2% of your earnings, fund retirement benefits.

- Medicare – 1.45% of your earnings, supporting the federal health insurance program.

- Health Insurance Premiums – If you participate in an employer-sponsored plan.

- Retirement Contributions – Such as 401(k) plans, often with employer matching.

- Other Voluntary Deductions – May include life insurance, disability insurance, or union dues.

Conclusion

Understanding types of income and their characteristics is important for effective financial planning and management. Income, whether earned, passive, or from investments, forms the foundation of an individual’s financial health. Each type affects your finances in its own way. You need to know about gross income and net income. These help you budget better.

Tax rules change based on where your money comes from. This is why having multiple income sources is smart. Your income’s regularity and source matter too. They change how you plan your money. Learning about income helps you make better choices. You can budget smarter and invest wisely. It helps with both short-term and long-term money goals. Whether you earn a salary or invest, knowing about income types is crucial. It helps you build a strong financial future.

FAQs

What is income?

Income is money you regularly receive from various sources such as wages, investments, or benefits. It’s typically calculated before taxes and deductions.

What is taxable income?

Taxable income is the portion of your total income subject to taxation. It’s calculated by subtracting allowable deductions and exemptions from your gross income.

Which income categories are tax-exempt?

Some tax-exempt income includes interest from certain government bonds, Roth IRA distributions, and specific government benefits. Always verify with current tax regulations.

What is not considered income?

Gifts, inheritances, and many healthcare benefits are generally not considered taxable income. However, exceptions exist, so consult a tax professional for specifics.

Is net income the same as profit?

While both represent money remaining after expenses, net income typically accounts for all business expenses, including taxes. Profit can vary in meaning depending on the specific calculation used.

Is all my income taxable, and how do I know?

Not all income is taxable. Review IRS guidelines or consult a tax professional to determine which portions of your income are subject to taxation. Factors like income source and amount can affect taxability.

What are some ways to make my income work for my financial goals?

To optimize your income:

- Create a budget to manage spending

- Invest in tax-advantaged accounts like 401(k)s or IRAs

- Consider diversifying income streams

- Explore passive income opportunities

- Continuously educate yourself on personal finance

- Seek professional advice for complex financial situations